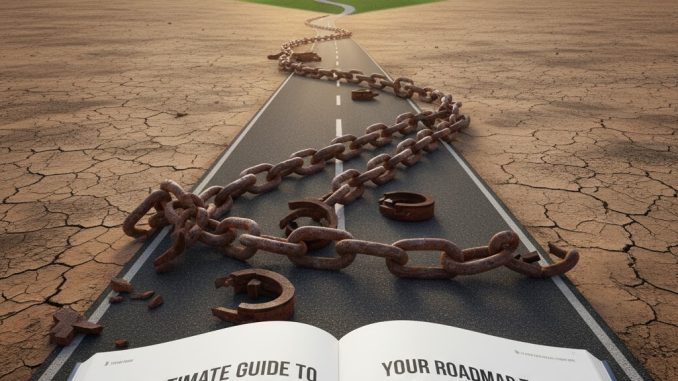

Debt can feel like a heavy chain, holding you back from your financial dreams. Whether it’s credit card debt, student loans, or a mountain of medical bills, the stress and interest payments can be overwhelming. But here’s the good news: crushing debt is entirely achievable, and you don’t have to navigate it alone.

This ultimate guide will provide you with a clear, actionable roadmap to pay off debt faster, regain control of your finances, and move towards a life of financial freedom.

Why Crushing Debt is Your #1 Financial Priority

Before diving into the “how,” let’s quickly touch on the “why.” High-interest debt, especially credit card debt, acts like a wealth destroyer. Every dollar spent on interest is a dollar you can’t save, invest, or use to improve your quality of life. By actively working to eliminate debt, you free up cash flow, reduce stress, and accelerate your journey toward building true wealth.

Step 1: Understand Your Debt (Face the Facts!)

You can’t defeat an enemy you don’t understand. The first crucial step to crushing debt is to get a complete picture of everything you owe.

- List All Debts: Create a spreadsheet or use a notebook. List every single debt you have.

- Key Information for Each Debt: For each debt, record:

- Creditor Name (e.g., Chase, Sallie Mae, Hospital)

- Current Balance Owed

- Interest Rate (APR)

- Minimum Monthly Payment

- Due Date

This exercise can be daunting, but it’s essential. Knowing these numbers empowers you to make informed decisions.

Step 2: Choose Your Debt Crushing Strategy

Now that you know what you’re up against, it’s time to pick your battle plan. There are two primary, highly effective strategies for paying off debt: the Debt Snowball and the Debt Avalanche.

The Debt Snowball Method

- How it Works: List your debts from smallest balance to largest balance, regardless of interest rate. Pay only the minimum on all debts except the smallest. Throw every extra dollar you have at that smallest debt until it’s paid off. Once it’s gone, take the money you were paying on that debt (minimum + extra) and apply it to the next smallest debt.

- Why it’s Effective: This method builds powerful psychological momentum. Each small debt you crush provides a “win” that motivates you to keep going. It’s fantastic for those who need regular encouragement.

The Debt Avalanche Method

- How it Works: List your debts from highest interest rate to lowest interest rate. Pay only the minimum on all debts except the one with the highest interest rate. Attack that high-interest debt with all your extra funds until it’s gone. Then, move to the debt with the next highest interest rate.

- Why it’s Effective: This is mathematically the most efficient way to pay off debt, as it saves you the most money on interest over time. If you’re highly disciplined and motivated by numbers, this is your strategy.

Which one is right for you? Choose the method that you’re most likely to stick with. Consistency is key when it comes to debt elimination.

Step 3: Slash Expenses & Boost Income (Fuel Your Debt Payments)

To truly crush debt fast, you need to free up as much money as possible to throw at your chosen debt. This means two things: cutting expenses and increasing income.

How to Cut Expenses:

- Create a Budget (and Stick to It!): This isn’t about deprivation; it’s about intentional spending. Track where every dollar goes and identify areas to reduce.

- The “No-Spend Challenge”: Try a week or even a month where you only spend on essentials (housing, food, transportation, debt minimums). You’ll be amazed at what you save.

- Negotiate Bills: Call your internet, cable, and even insurance providers. Ask for lower rates. You’d be surprised how often they’ll oblige to keep your business.

- Review Subscriptions: Cancel unused gym memberships, streaming services, or apps.

- Eat at Home: Dining out and takeout add up quickly. Meal planning and cooking at home are huge money savers.

- Limit Impulse Buys: Implement a 24-hour rule before making non-essential purchases.

How to Boost Your Income:

- Side Hustles: Deliver food, walk dogs, freelance your skills, or sell items online. Even a few hundred extra dollars a month can significantly accelerate your debt payoff.

- Ask for a Raise: If you’re performing well at your job, prepare your case and ask for what you’re worth.

- Sell Unused Items: Declutter your home and make some cash in the process. Clothes, electronics, furniture – one person’s trash is another’s treasure.

- Overtime Hours: If available at your job, consider picking up extra shifts temporarily.

Step 4: Consider Debt Consolidation or Refinancing (When Appropriate)

For some types of debt, especially high-interest credit card debt or student loans, debt consolidation or refinancing can be a smart move.

- Debt Consolidation Loan: This involves taking out a new loan (often with a lower interest rate) to pay off multiple smaller, high-interest debts. You’re left with just one monthly payment. Be cautious: only do this if you are committed to not accumulating new debt.

- Balance Transfer Credit Cards: Some credit cards offer 0% APR on balance transfers for an introductory period (e.g., 12-18 months). This can be a powerful tool to pay off credit card debt without accruing interest – if you pay it off entirely before the promotional period ends.

- Student Loan Refinancing: If you have good credit, you might be able to refinance private student loans to a lower interest rate, saving you thousands over the life of the loan. Be careful with federal loans, as refinancing converts them to private, and you lose federal protections.

Always do your research and ensure any new loan or card genuinely helps you pay less in interest and crush debt faster, rather than just shuffling it around.

Step 5: Stay Motivated & Celebrate Wins

Crushing debt is a marathon, not a sprint. There will be tough months, but staying motivated is crucial.

- Track Your Progress: Visually seeing your balances shrink can be incredibly motivating. Use apps, spreadsheets, or even a “debt thermometer” chart.

- Set Mini-Goals: Instead of just focusing on the huge total, celebrate paying off your first small debt, or reaching a certain percentage paid down.

- Reward Yourself (Sensibly): Once a debt is paid off, allow for a small, non-financial reward. A nice meal at home, a movie night, or a new book.

- Find an Accountability Partner: Share your goals with a trusted friend or family member who can cheer you on.

The Road to a Debt-Free Future

Imagine the freedom you’ll feel when those debt payments are gone, and that money is redirected towards your dreams – saving for a home, investing for retirement, or even taking that dream vacation.

Crushing debt takes discipline, effort, and a solid plan, but it’s one of the most empowering financial journeys you can undertake. Start today, stay consistent, and watch your debt disappear, paving the way for true financial freedom.

Leave a Reply